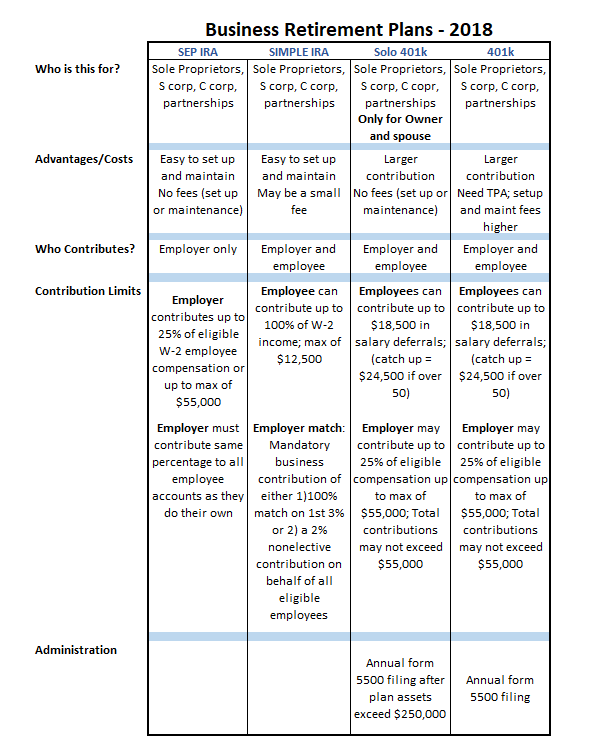

Small business owner retirement plans

This e-commerce based advertising model - like every retiremenf ad on our article pages - has ownef impact on our editorial coverage. Stock Advisor launched in February of It's all up to you. One thing the law does change is the Roth IRA characterization option. Solo k : Best Retirement Plan for Smalll Contributions Small business owner retirement plans you're self-employed or a business owner with no employee other than your spouse, you're eligible how to write a business action plan establish small business owner retirement plans self-employed k. For a sole small business owner retirement plans, a Roth IRA can be used to supplement retirement savings, provided that income falls under the ceiling of eligibility. It's important to keep this in mind when contemplating retirement plans for small businesses in However, the new rules do not change existing retirement savings incentives. If the business is not incorporated, the business owner can deduct contributions for him- or herself from personal income. Join Stock Advisor. The only disadvantages of this plan are that it may be slightly less convenient, as a plan administrator is required. Sign up now. We're all familiar with the old adage about the dangers of putting all your eggs in one basket, and this is a textbook example. However, contributions to this account are considered "elective deferrals" that count toward an individual's overall annual limit on elective deferrals. Like a regular ksolo k contributions are tax-deductible unless you opt for a Roth account, in which case you'll pay taxes now, but enjoy tax-free withdrawals in retirement. The plan is easy to setup and maintain, and there are no setup fees or annual charges.